#Ewallet app update

How can I update my mobile number on Touch ‘n Go eWallet? The new PIN that will be sent to you will enable you to withdraw funds from your account without fail. In case your eWallet PIN expires before you complete your transaction, you can request for another PIN to be sent to you by dialing *120*277#.

The eWallet PIN can only be reset using the dial string *120*277#.Ĭan the sender request a new eWallet PIN? This will allow you to buy airtime from the eWallet funds. Note: If you have no airtime, dial *130*277#. How can I get a new eWallet PIN without airtime? SEEK is listed on the Australian Securities Exchange, where it is a top 100 company and has been listed in the Top 20 Most Innovative Companies by Forbes.Step 1: Dial *120*277*1# on your cellphone.Step 2: Press 1 to request a new eWallet PIN.Step 3: You will receive an SMS from FNB with your new eWallet 4-digit PIN.Step 4: Visit your nearest FNB ATM and use your new eWallet PIN to withdraw cash. SEEK makes a positive contribution to people’s lives on a global scale. SEEK has a global presence (including Australia, New Zealand, China, Hong Kong, South-East Asia, Brazil and Mexico), with exposure to over 2.9 billion people and approximately 27 per cent of global GDP. SEEK is a diverse group of companies, comprising a strong portfolio of online employment, educational, commercial and volunteer businesses. SEEK Asia attracts over 400 million visits a year. SEEK Asia is part of the Australian Securities Exchange-listed SEEK Limited Company, the world’s largest job portal by market capitalisation. SEEK Asia’s presence span across 7 countries namely Hong Kong, Indonesia, Malaysia, Singapore, Thailand, Philippines and Vietnam. SEEK Asia, a combination of two leading brands JobStreet and JobsDB, is the leading job portal and Asia’s preferred destination for candidates and hirers. And as the number 1 Talent Partner in Asia, we connect employers with the right candidates who truly make a positive and lasting impact on the organisation.ĭiscover Jobs That Matter. As a Career Partner, we are committed to helping all jobseekers find passion and purpose in every career choice. To help you narrow down your options, here are some of the best e-wallets in Malaysia to consider.Īt JobStreet, we believe in bringing you #JobsThatMatter. Therefore, it can be challenging to go through each and choose just one or two. In fact, Fintech Malaysia reported a total of 53 platforms in 2019.

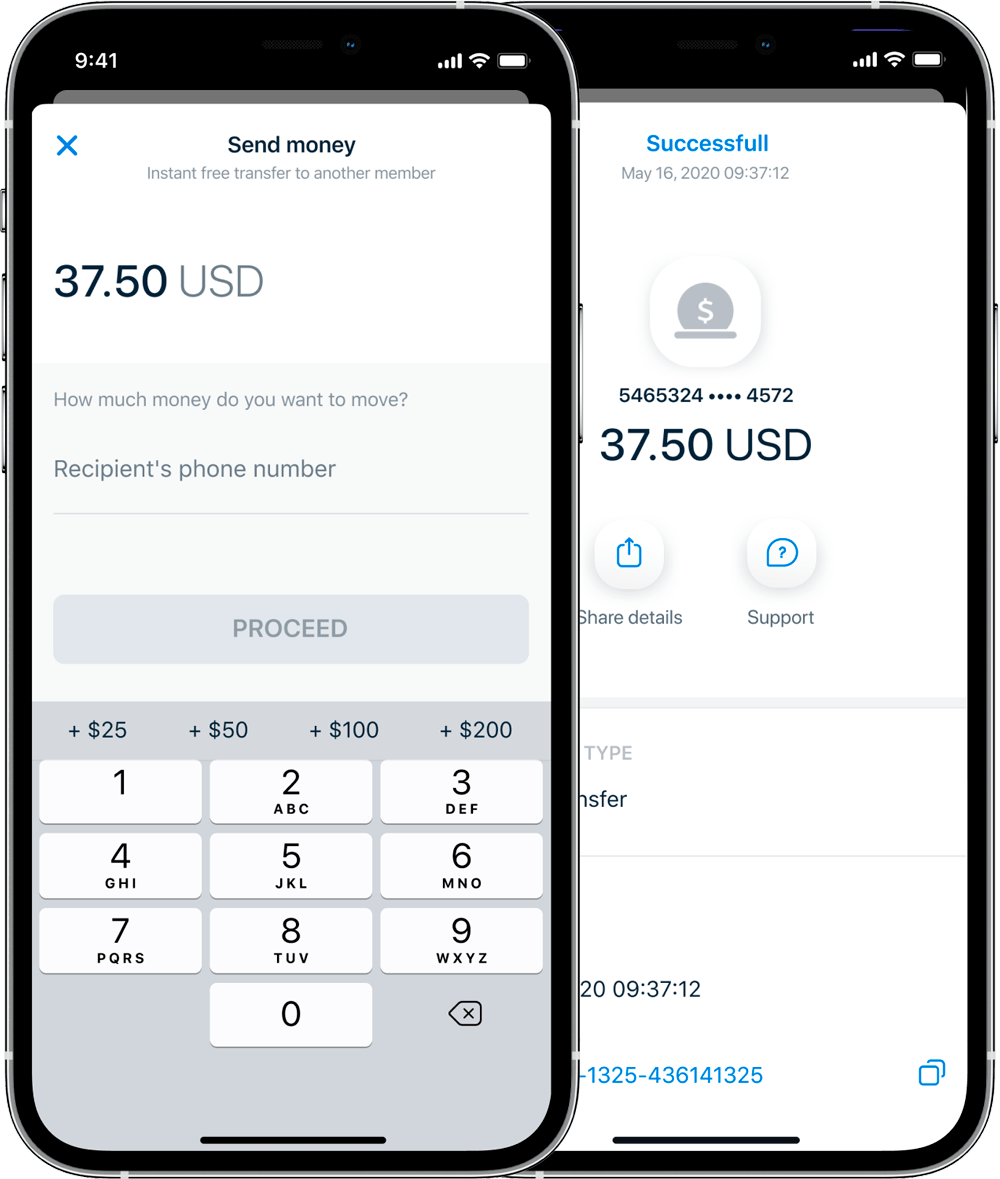

The e-wallet industry has actually been booming in the country. Providers implement strict online security measures to ensure that all transactions and user information are safe and secure. The payment details typically stored in an e-wallet include credit card data, debit card data, bank account details, and other payment platforms. With e-wallets in Malaysia, you don’t need to use a physical card, pay with cash, or make bank branch transactions. Make a purchase? Paying for a service through a web store or app? E-wallets instantly provide the information needed to complete that transaction.

If you are yet to use an e-wallet, you must be wondering, what is it and how does it work? As its name indicates, it is an electronic wallet that keeps track of your payment information.

0 kommentar(er)

0 kommentar(er)