Personal budget book how to#

Follow our step-by-step guide on how to budget and start your own budget in less than 10 minutes! This is how we started our first budget, and it is still how we handle our personal budget to this day. In fact, all you need is a pen and paper. Paper Budget - One of the greatest things about creating a budget is that you don’t need a lot of stuff to get started.Ready to get change your financial life? Here are three ways you can get started today! Although we have personally found the greatest amount of success using this style of budgeting, the most important thing you can do is to get started using any style of budget and stick to it. It accomplishes this by planning for every penny that is earned and spent each month. The goal of zero-based budgeting is to provide the user with a maximum amount of control over their money. Our favorite style of personal budget is a zero-based budget.

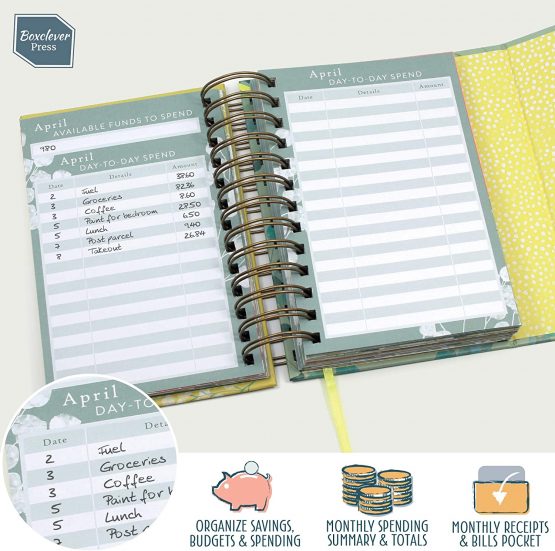

These budgets can also be found in various forms - including a physical paper budget, a spreadsheet, and other forms of electronic budgets and apps. Each type of budget attacks planning in its own way, and all of them come with their own set of pros and cons. There are many different styles of personal budgets available. Personal budgets also may include a section for tracking the user’s actual spending, although this is not required. The user’s expenses are further separated into spending categories which helps make planning easier. The budget includes sections for both income and expenses. A personal budget is a financial tool used by individuals and families that helps create a plan for their monthly income and expenses.

0 kommentar(er)

0 kommentar(er)